Noble 2025 Wrapped

Adi Ravi Raj

Introduction

2025 has been the year when stablecoins crossed the chasm from a niche crypto-product used within one corner of the internet, to mainstream institutional as well as individual awareness and adoption.

Stablecoin supply grew 135% this year to $310B. The U.S. signed its first comprehensive stablecoin legislation, providing regulatory clarity and a framework for global coordination. And we’ve seen widespread adoption of the technology from banks and fintechs like Visa, Klarna, and MoneyGram, to U.S. states like Wyoming launching their own stablecoin.

As a team focused on stablecoin and RWA issuance, we’ve had a strong year at Noble - perhaps the strongest yet - with product launches that we’re proud of, to a series of important milestones and achievements.

Here’s a look back at what we shipped as we prepare for a significant 2026:

Launched a yield-bearing stablecoin with M0

In March, we launched Noble Dollar (USDN), a yield-bearing stablecoin fully backed by U.S. Treasuries. It is the only yield-bearing stablecoin on the market today that developers can integrate with programmable control over yield routing - whether to users, liquidity pools, vaults, protocol incentives, or custom application logic.

Since it launched, the performance of USDN has been noteworthy:

Hit $127M in circulating supply within 4 months of launch

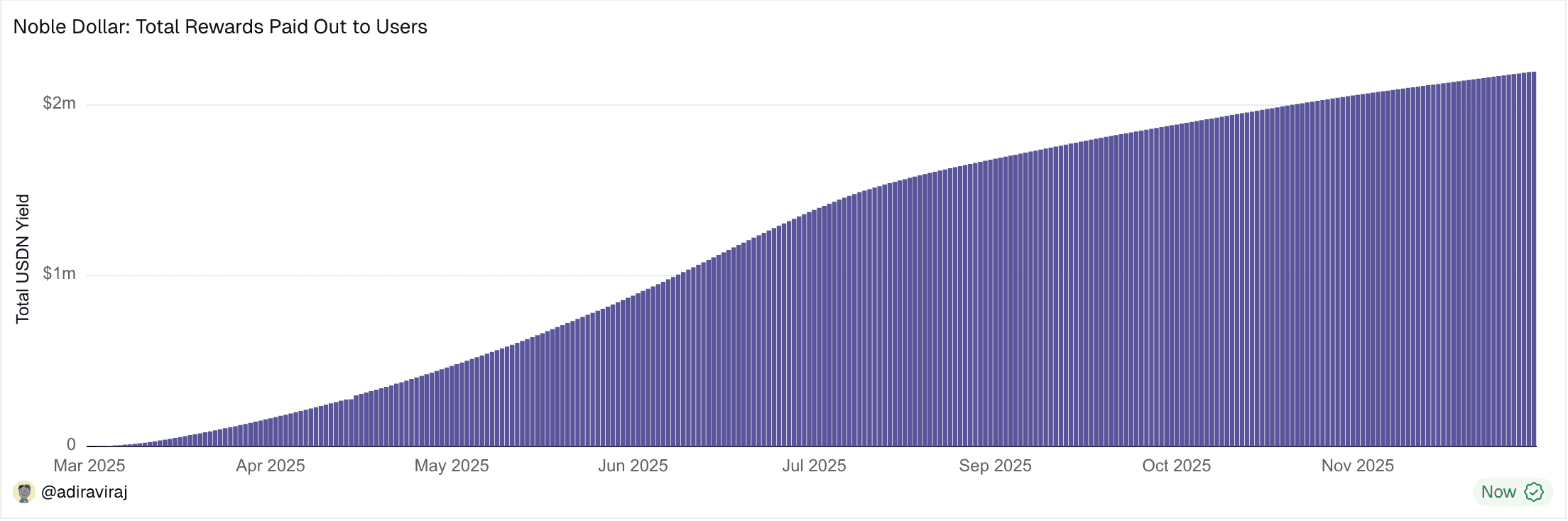

Paid out a total of $2.3M in Treasury rewards to a total user base of 35K wallets

Surpassed $1B in transaction volume with $533M in swap volume

Reached $1.2M in protocol revenue

Noble Dollar: Total U.S. Treasury Rewards Paid to Users, Source: Dune

Alongside the launch of USDN, we deployed a USDN/USDC swap pool on the Noble blockchain, the logic for which is governed by the swap module we built.

The swap module employs the StableSwap algorithm, orchestrating interactions between users and the USDN/USDC liquidity pool in a way that minimizes slippage to offer optimal rates. Since the launch of the swap module alongside USDN in March, the average slippage per swap has been merely -0.001%.

Deployed two USDN vault products

USDN launched alongside two vaults:

Points vault: users deposit USDN to receive points, redeemable for the NOBLE token when it launches in 2026, whilst foregoing the base Treasury yield.

Boosted yield vault: users deposit USDN to receive the base yield, along with the yield foregone by points vault users, creating a boosted yield of ~8-13%.

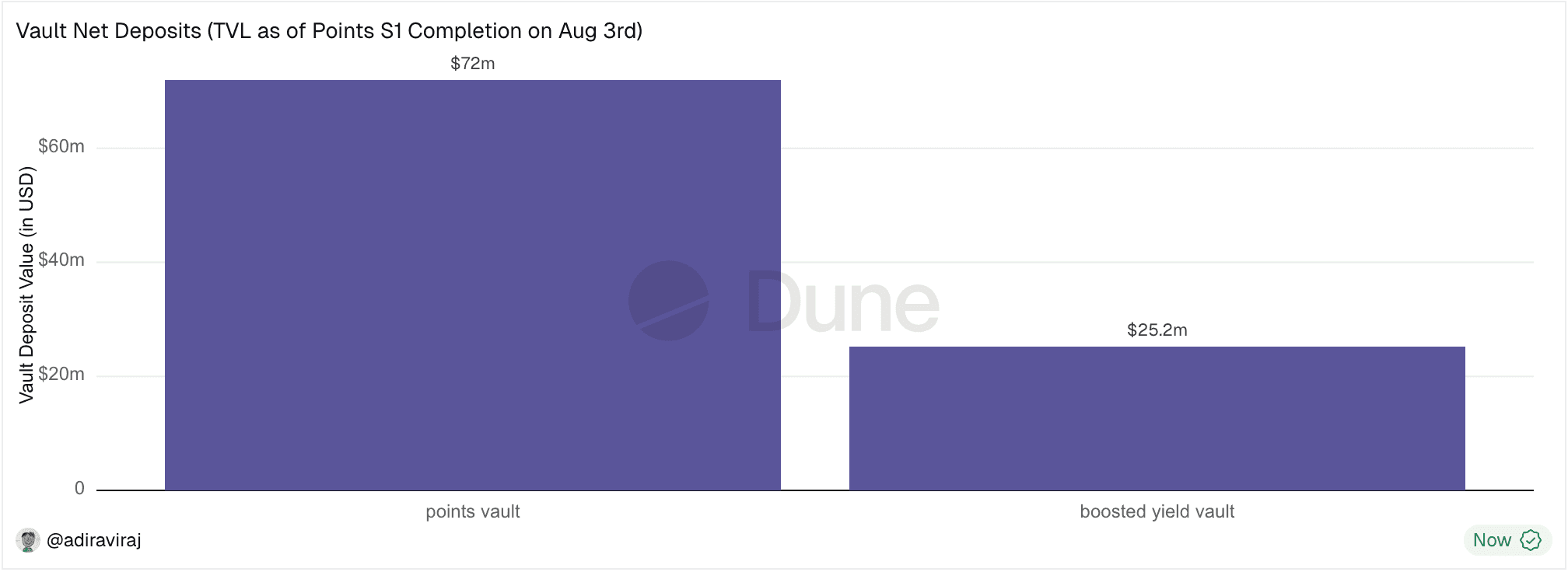

Noble Dollar Vaults: TVL as of Points Season 1 Completion on Aug 3rd, Source: Dune

At the end of the Noble Points program Season 1 (March 5 - Aug 4), the points vault had a total of $72M in deposits, while the boosted yield vault had $25M.

Out of the 35K total USDN holders, 95% of them interacted with the points vault with an average deposit value of $2.5k, and 8.5% interacted with the boosted yield vault with an average deposit value of $29k.

Launched Orbiter

In October, we cut the Flux release, which introduced the Orbiter module. As of writing, Orbiter has handled over $2M of transaction volume with an average transaction value of $6.5k.

Orbiter is a middleware on Noble that can receive cross-chain transactions, execute custom actions on Noble, like fee payments or swaps, and then forward the transaction to a pre-specified destination chain.

From a user perspective, all actions are handled in a single transaction instead of having to sign multiple. For example, if a user holds USDC on Base and wants USDN on Hyperliquid, they can send their USDC to Orbiter on Noble. Orbiter swaps it to USDN and routes it to Hyperliquid, all in a single user-signed transaction.

Kicked off the NOBLE token claims process

In October, we began Step 1 of the NOBLE token claims process, whereby users can link their Noble address to an EVM address to receive their airdrop allocation. Within two weeks, nearly 90% of the total USDN user base had already linked their addresses.

Other cool milestones that we hit this year

Apart from the products that we launched in 2025, here are some other milestones that we achieved this year:

$20B+ in total stablecoin volume processed.

In June, we hit 650M in stablecoins issued, which includes USDN and native USDC.

Crossed 300K wallets that interacted with native USDC on Noble, with a 6-month USDC MAU (monthly active users) average of 28K.

The forwarding module that we built, which handles automated transactions from EVM chains -> Noble -> IBC-enabled chains (like dYdX), surpassed $2.5M in transaction volume handled.

Processed a total of 4.6M successful transactions.

What to look forward to in 2026

Managed Vault

After the ongoing Points Season 2 campaign concludes, a managed vault product will be deployed on Hyperliquid, where users can deposit USDN to receive additional yield on top of the Treasury rewards. We’re aiming for a tentative timeline towards the end of Q1 2026 for launch.

Noble EVM

Stablecoins have hit escape velocity this year. Increased appetite from institutions and individuals to spend, save, and invest in stablecoins demands a high-performant technological stack that can adequately cater to those evolving needs.

At Noble, we care deeply about staying at the cutting edge of technology to remain one of the market leaders in stablecoin adoption. To this end, and without giving away too much, we’re revamping aspects of Noble to better serve our customers!

Partnership with [REDACTED]

To be announced soon 👀

Conclusion

2025 has been a defining year for us as well as the industry overall. We shipped products that people love to use, hit organic milestones, and laid the groundwork for what's coming. Thank you for being part of the journey so far, and here's to an even bigger 2026!